Record Sales of $19.1 million, Net Earnings of $1.8 million

MISSISSAUGA, December 22, 2022 – Microbix Biosystems Inc. (TSX: MBX, OTCQX: MBXBF, Microbix®), a life sciences innovator, manufacturer, and exporter, reports results for its year and fourth quarter ended September 30, 2022 (“2022” and “Q4”), with record sales and continued positive net earnings, plus ongoing progress upon its strategic goal of increasing its capacity for medical devices production and, over time, to thereby grow sales, margins, and earnings.

Management Discussion

2022 sales achieved a new record of $19.1 million as Microbix continues to emphasize operational excellence and increase sales of innovative, proprietary, and branded medical devices. Sales of test quality assessment products (“QAPs™”) and viral transport medium (“DxTM™”) each realized double-digit percentage increases over fiscal 2021. Sales of antigens were down versus prior year due to continued pandemic impacts on the diagnostics business. Product royalties were higher than 2021 due to higher sales from licensees. Overall, sales achieved a favourable gross margin but were suppressed by inflationary pressures. On a net basis, these factors resulted in strong EBITDA performance and continued positive operating and net income. Microbix continues to pursue growth in sales of its medical devices and expects that full-year fiscal 2023 will realize further sales growth and continuing positive net earnings.

Year ending September 30, 2022 (“2022”)

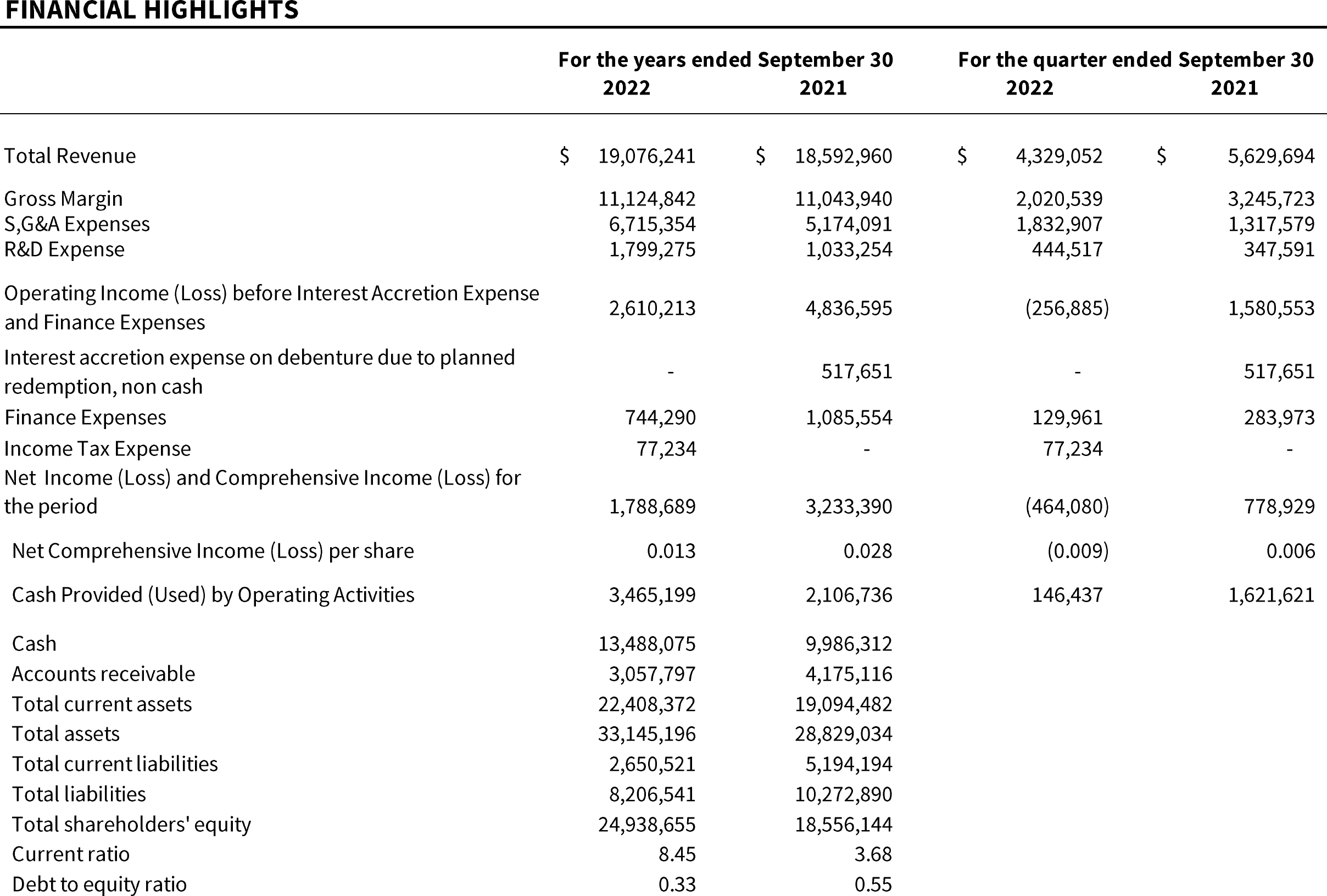

2022 revenue was $19,076,241, a 3% increase from prior year revenues of $18,592,960. Included were antigen revenues of $8,287,908 (2021 – $9,082,021). QAPs revenues grew by 14% in 2022 to $5,375,329 (2021 – $4,704,671). Revenue from DxTM was strong in 2022 at $5,004,359, up 11% from the prior year (2021 – $4,506,900), and royalties were $408,694 (2021 – $299,368). 2022 revenues were most influenced by the continued uptake of our growing base of QAPs products and strong DxTM sales.

2022 gross margin was 58%, down slightly from 2021 gross margins of 59%. Margins were impacted by increased labour and manufacturing expenses, and higher supply costs; all due to inflationary pressures.

Operating and finance expenses in 2022 increased by 19% relative to 2021, due to increased QAPs product development, investment in IT infrastructure, additional marketing spend to support sales growth, and there being no grant funding as had been received in fiscal 2021; collectively offsetting reduced interest costs due to the repayment of debt and greater interest income from short-term investments.

Stronger sales were offset by lower percentage gross margin and increased operating expenses (due to increased investment into business growth and infrastructure), leading to an operating income (before finance expenses) of $2,610,213 and net income of $1,788,689 versus a 2021 operating income of $4,836,595 and net income of $3,233,390. Cash provided by operating activities was $3,465,199 compared to $2,106,736 in 2021, an improvement largely driven by non-cash working capital account balances.

At the end of 2022, Microbix’s current ratio (current assets divided by current liabilities) was 8.45 and its debt to equity ratio (total debt over shareholders’ equity) was 0.33. Both of these financial health ratios continued to improve from those in 2021.

Quarter Ending September 30, 2022 (“Q4”)

Q4 revenue was $4,329,052, down from 2021 revenues of $5,629,694. Included were antigen sales of $2,629,783 (2021 – $2,020,861), up 30% due to order timing and some bounce-back in business. QAPs revenues were $1,601,950 up 34% in fiscal 2022 (2021 – $1,195,545). In turn, revenue from DxTM was $0 due to timing of orders (2021 – $2,327,600), and royalties were $97,319 (2021 – $85,689). The Q4 sales decline was most influenced the lack of Ontario-driven deliveries of DxTM, offset by continued diagnostics industry uptake of QAPs and stronger antigen sales.

Q4 gross margin was 47%, down from 58% during Q4 2021, due to a greater proportion of lower margin antigen sales, the antigen product sales mix for the quarter, and the lack of DxTM sales in the quarter.

Operating expenses (including financial expenses) in Q4 were relatively flat when compared to Q4 2021. The quarter also showed greater QAPs product development investment, additional spending in sales and marketing to support sales growth, and the lack of Ontario Together Fund (“OTF”) grant funding this year vs. last year. This was offset by a reduction in interest costs due to the repayment of debt and increased short term investment income in fiscal 2022.

Overall, lower sales and less available gross margin dollars led to a Q4 operating loss (before finance expenses) of $256,885 and net loss of $464,080 versus Q4 2021 operating income of 1,580,553 and net income of $778,929. Cash provided by operating activities was $146,437 for Q4, compared to cash provided by of $1,621,623 for Q4 2021, with the majority of the change coming from change in Q4 operating income and changes in non-cash working capital.

Corporate Outlook

Microbix will continue to drive sales growth across all of its three revenue-generating business lines, and work to keep improving percentage gross margins and driving bottom-line results. Management currently expects Microbix to generate meaningful net earnings growth across full-year fiscal 2023. Additionally, work continues upon securing a partnership to advance its Kinlytic® urokinase project.

Adelaide Capital will host a live webinar with management, on Wednesday, January 4 at 11am ET. Please register here: https://us02web.zoom.us/webinar/register/WN_u90QQLfDQreHCHkwoPMa0A .

It will also be live-streamed to YouTube at: https://www.youtube.com/channel/UC7Jpt_DWjF1qSCzfKlpLMWw.

A replay of the webinar will also be made available on Adelaide Capital’s YouTube channel.

About Microbix Biosystems

Microbix creates proprietary biological products for human health, with over 100 skilled employees and annualized sales targeting C$ 2.0 million per month. It makes a wide range of critical ingredients and devices for the global diagnostics industry, notably antigens for immunoassays and its laboratory quality assessment products (QAPs™) that support clinical lab proficiency testing, enable assay development and validation, or help ensure the quality of clinical diagnostic workflows. Its antigens drive the antibody tests of over 100 diagnostics makers, while QAPs are sold to clinical laboratory accreditation organizations, diagnostics companies, and clinical laboratories. Microbix QAPs are now available in over 30 countries, distributed by 1WA (Oneworld Accuracy Inc.), Alpha-Tec Systems, Inc., Diagnostic International Distribution SpA., Labquality Oy, The Medical Supply Company of Ireland, Neo-Science Equipment LLC, R-Biopharm AG, SDT Molecular Pte Ltd, Seegene Canada Inc., and Thomas Scientific LLC. Microbix is ISO 9001 and 13485 accredited, U.S. FDA registered, Australian TGA registered, Health Canada establishment licensed, and provides CE marked products.

Microbix also applies its biological expertise and infrastructure to develop other proprietary products and technologies, most notably viral transport medium (DxTM™) to stabilize patient samples for lab-based molecular diagnostic testing and Kinlytic® urokinase, a biologic thrombolytic drug used to treat blood clots. Microbix is traded on the TSX and OTCQX, and headquartered in Mississauga, Ontario, Canada.

Forward-Looking Information

This news release includes “forward-looking information,” as such term is defined in applicable securities laws. Forward-looking information includes, without limitation, discussion of financial results or the outlook for the business, risks associated with its financial results and stability, its current or future products, development projects such as those referenced herein, sales to foreign jurisdictions, engineering and construction, production (including control over costs, quality, quantity and timeliness of delivery), foreign currency and exchange rates, maintaining adequate working capital and raising further capital on acceptable terms or at all, and other similar statements concerning anticipated future events, conditions or results that are not historical facts. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. The Company cautions that all forward looking information is inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond the Company’s control. Accordingly, actual future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. All statements are made as of the date of this news release and represent the Company’s judgement as of the date of this new release, and the Company is under no obligation to update or alter any forward-looking information.

Please visit www.microbix.com or www.sedar.com for recent Microbix news and filings.

For further information, please contact Microbix at:

| Cameron Groome, CEO

(905) 361-8910 |

Jim Currie,

CFO (905) 361-8910 |

Deborah Honig,

Investor Relations Adelaide Capital Markets (647) 203-8793 ir@microbix.com |

Copyright © 2022 Microbix Biosystems Inc. Microbix®, DxTM™, Kinlytic®, and QAPs™ are trademarks of Microbix Biosystems Inc.